AICPA Accounting Fundamentals 1-2

Chapter I Introducation to Financial Statements

What's is Accounting?

Measure Business Activeties ; Process data into reports ; Communicate results to desicion makers ; Produce financial statements

User of Financial Information :

Investor (Owners ) make desicions buy ,hold or sell stock ;

Creditors evaluate the risks credit or lend money;

Customers are interested in whehter a company will continue ,honor product warrenties;

Labor Unions want to know whether the owners have the ability to pay increased wages and benefits;

Regulatory agencies want to know whether the company is operating within prescirbed rules.

Internal users : Markerting Manager, Production supervisors , Finance directors , Company officers.

Financial comparisons of operating alternatives ; Projection of income from new sales campaigns ; Forecasts of cash needs for the next year.

External Users: Existing and potential investors ; Lenders ; Other Creditors ; Regulators ; Members of the public.

Forms of Business Organization

Sole General Ptrship L. L. P. L.P. L.L.C S Corp. C Corp. Formation No Formation No Formalities (3 elements) File with State File Certificate of LP with state File articles of Organization with state File articles of incorp. with state+"S"election File articles of incorp. Duration Limited(Until owner died) Limited Limited Limited Limited Depends on election rule Unlimited Management Sole proprietor Partners Partners General Partners Members or managers BOD which appoint officers run day- to- day operations Owner Liability Unlimited Unlimited Limited to contribution,except for partners' own torts. GP : Unlimited;

LP : LimitedLimited to contribution, except for membersl own torts Limited to contribution,except for shareholders' own torts Transferability of ownership interest At owners' will Require unanimous consent Freely transferable but can not break S-Corp Restrictions Freely Transferable Taxation "Flow Through " Owner Taxed Double Tax Sole - Sole Proprietorship; General Ptrship- General Partnership ;L.L.P - Limited Liability Partnership ; L.P. - Limited Partnership ;

L.L.C. - Limited Libility Corporation ; Corp. - Corpation ; Incrop. - Incorpation ; GP - Gneral Partner ; LP - Limited Partner

Busniess Activities: Financial Activities ; Investing Activities ; Operating Activities ;

Fiancial activities include : Debt Financing(Liability) borrowing money[Borrow money directly form the bank "Notes",or borrowing from investor by issue debt securities "Bonds" ] and Equity Financing (Equity) issuing or "selling " share of stocks to investors , Debt financing interest as cost of financing produce "Tax of Shield" .

Investing Activities : Purchase of the resources a corp. needs in order to operate. purchase or sale of Non-Current Assets ; All sums lent and/or repaid. Non-current Assests ,held by a crop. for more than a year.

Operating Activities : All transactions not categorized as invesing or financing acitivities are categorized as operating activites. include delivering or producing goods for sale and providing services.

Revenues and Expenses : amounts earned on the sale of these products or services revenues. Revenue is the increase in assets or decrease in liabilities (and or both) resulting from the sale of goods or performance of services in the normal course of business. Recording the nature of the business, sales revenue ,service revenue and interest revenue. Expenses are the cost of assests consumed or services used in the process of generating revenues. Expense is the reducation of assets or increase of liabilities. Expenses are identified by various names depending on the type of asset consumed or service used: Cost of good sold , Selling Expenses , Marketing Expenses(Advertising fee), Administrative expenses (Administrative staff telephone, heating costs incurred at the corp. office ), Interest expense , Income tax , sales tax etc.

Net income / Loss : Revenues exceed expenses , a net income results . Expenses exceed Revenues is net loss.

Income statement : Revenues and expenses , a period of time

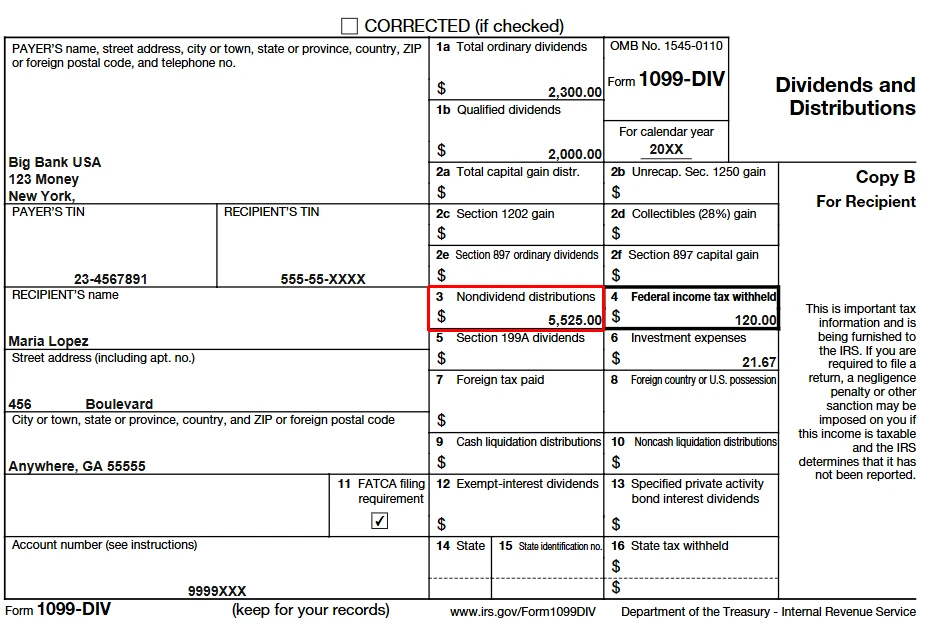

Retained Earnings Statement : indicate how mush of period income was distrubuted or diviends ,How mush retained in business to allow for future growth.

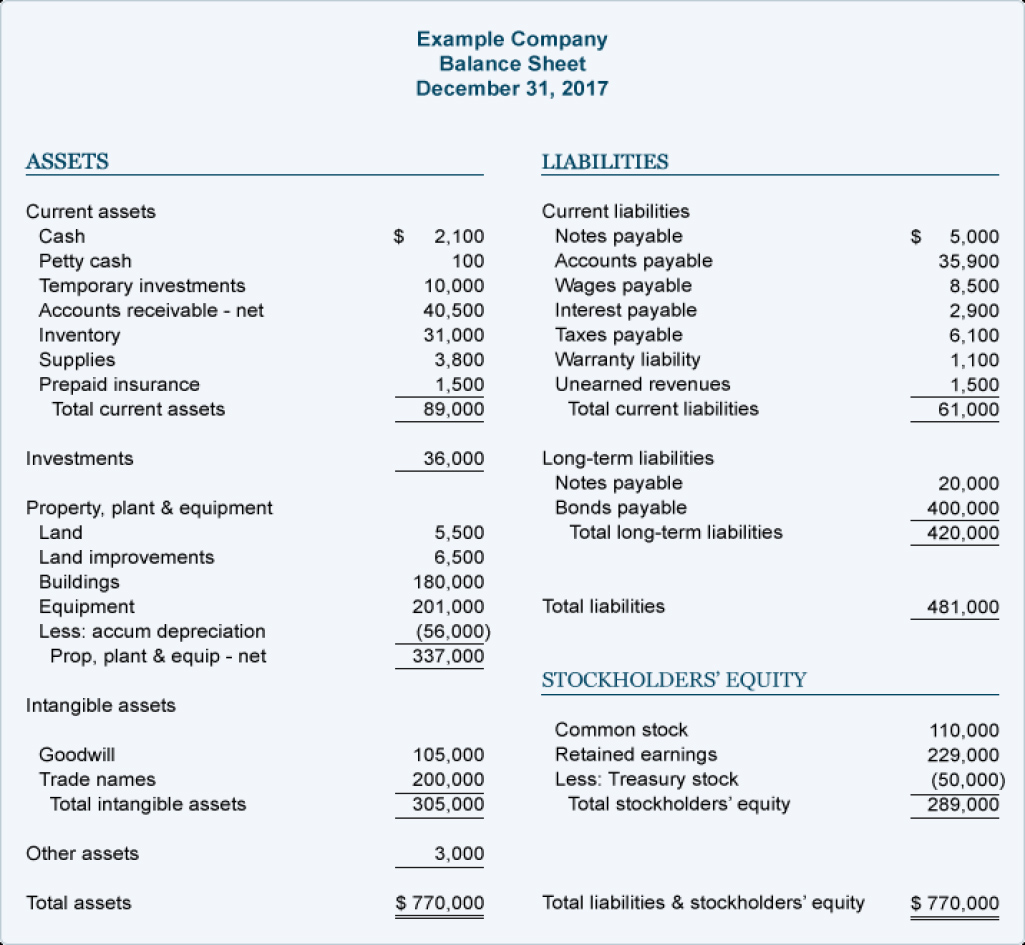

Balance sheet (Snap shot): At a time point your business owns( its asset), and owes (its liabilities).

Cash flows : where your business obtained cash during a period of time, how that cash was used.

Management Discussion and Analysis (MD&A) ; Notes to the financial statements ; Auditor's Report ; Contingencies, uncertainties, various statistics and detail voluminous.

Chapter 2 A Further Look at Financial Statements

1. The classified balance sheet: a certain date, useful because items within a group have similar economic characteristics; Current and Non-Current ;

Assets: Current assets; Long-term investments; Property, plant and equipment (PPE) ;Intangible assets ; Other assets

Liabilities and Stockholders' Equity : Current liabilities ; Noncurrent or long-term liabilities ; Stockholders' Equity

Assets = Liabilities + Equity

Operating Cycle : Operating Cycle = Inventory Period + Accounts Receivalbe Period ; The Operating Cycle tracks the number of days between the initial date of inventory purchase and the receipt of cash payment from customer credit purchases.

Current Assets include : Cash and cash equivalents (include U.S Treasury securities or other financial instrument Orginal maturing less than 90 days ,easily convertible to cash), Short-term investments , Accounts Receivable (AR )and notes receivable (NR), Merchandise inventory , Other current assets like prepaid expenses(advance for advertising, rent , insurance , taxes and supplies).

Long -Term Investments : investments in stocks and bonds of other corporations that are held for more than one year; long-term assets such as land or buildings that a company is not currently using in its operating activities, and long-term notes receivable.

Property, Plant, and Equipment are assets with relatively long useful lives that are currently used in operating the business, including: Land , Buildings , Equipment , Delivery vehicles ,Furniture

Depreciation : Depreciation is the allocation of the cost of an asset to a number of years. Systematically assigning a portion of an asset’s cost as an expense each year; accumulated depreciation account shows the total amount of depreciation that the company has expensed ; The assets that the company depreciates are reported on the balance sheet at cost less accumulated depreciation

Intangible Assets : Intangible assets are assets that lacks physical substance (unlike physical assets such as machinery and buildings) and usually are very hard to evaluate : Patents; Copyrights; Franchises; Goodwill; Trademarks and trade names; Software and other intangible computer based assets. Intangible assets Amortization; (Mineral and natual resource use Depletion method.)

Current Liabilities : are obligations that the company is to pay within the next year or operating cycle, whichever is longer. Accounts payable, salaries and wages payable, notes payable, interest payable, income taxes payable;

Long-term liabilities, or non-current liabilities, are liabilities that are due beyond a year or the normal operation period of the company. Liabilities in this category include bonds payable, mortgages payable, long-term notes payable, lease liabilities, and pension liabilities.

2. Using the financial Statement :

Ratio Analysis :

Ratios are very useful to financial analysis, as they provide input for evaluating and comparing a company to its peers, or to an industry benchmark.

Intracompany comparisons covering two years for the same company.

Industry-average comparisons based on average ratios for particular industries.

Intercompany comparisons based on comparisons with a competitor in the same industry.

Profitability Ratios

Measure the income or operating success of a company for a given period of time.

Liquidity Ratios

Measure short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash.

Solvency Ratios

Measure the ability of the company to survive over a long period of time.

The income statement :

Reports how successful it is at generating a profit from its sales;

Reports the amount earned during the period (revenues) and the costs incurred during the period (expenses);

Evaluate the profitability of a company.

Profitability ratios, such as earnings per share, measure the operating success of a company for a given period of time.

Earnings per share (EPS) measures the net income earned on each share of common stock. Stating net income earned as a per share amount provides a useful perspective for determining the investment return.

EPS = (Net Income -Preferred Dividend) / Average Common Shares Outstanding

Average Common Shares Outstanding = (Common shares outstanding at the beginning of year + Common shares outstanding at the end of year)/2

Using the Statement of Stockholders’ Equity :The retained earnings statement describes the changes in retained earnings during the year.

Beginning Retained Earnings +Net income -(Dividend) = Ending Reatained Earnings

Stockholders' equity is compried of two parts : Retained earnings and Common Stock.

Liquidity : Suppose you are a banker considering lending money to a company, or you are a sales manager interested in selling goods to the company on credit.

o Liquidity - Working Capital

Working Capital = Current Assets - Current Liabilities

Positive working capital : Greater likelihood that the company will pay its liabilities ; Negative working capital: A company might not be able to pay short term creditors.

Liquidity - Current Ratio : Current Ratio is another liquidity ratio, computed as current assets divided by current liabilities.

Current Ratio = Current Assets / Current Liabilities

Current Ratio is more dependable indicator of liquidity than working capital.Potential weakness of the current ratio is that it does take into account the composition of the current assets.

A current ratio of 1.0 or greater is an indication that the company is well-positioned to cover its current or short-term liabilities;

A current ratio of less than 1.0 could be a sign of trouble if the company runs into financial difficulty; Higher ratio suggests favorable liquidity.

Solvency : Solvency is a company's ability to pay interest as it comes due and to repay the balance of a debt due at its maturity.Solvency ratios measure the ability of the company to survive over a long period of time.

Long-term creditors and stockholders are interested in a company’s solvency—its ability to pay interest as it comes due and to repay the balance of a debt due at its maturity.

Solvency - Debt to Assets Ratio :

Debt to Assets Ratio=Total Liabilities / Total Assets

The debt to assets ratio is one measure of solvency. It calculated by dividing total liabilities (both current and long-term) by total assets. Debt financing is more risky than equity financing because debt must be repaid at a specific points in time; The higher the percentage of debt financing, the riskier the company; A ratio greater than 1 indicates that a company may be putting itself at risk of not being able to pay back its debts, which is a particular problem when the business is located in a highly cyclical industry where cash flows can suddenly decline. Lower value suggests favorable solvency.

3. Financial Reporting Concepts

GAAP : Generally Accepted Accounting Principles (GAAP) ; GAAP is a set of accounting standards that have authoritative support.

SEC : The Securities and Exchange Commission (SEC) is the agency of the U.S. government that oversees U.S. financial market and has the legal authority to establishU.S. generally accepted accounting principles (GAAP). Usually, the SEC has allowed the accounting profession to establish GAAP and self-regulate.

The Financial Accounting Standard Board (FASB)is the primary accounting standard-setting body in the United States.

The International Accounting Standards Board (IASB)issues standards called the International Financial Reporting Standards (IFRS), which has been adopted by many countries outside of the United States.

The Public Company Accounting Oversight Board (PCAOB)determines auditing standards and review the performance of auditing firms.

Today, the FASB and IASB are working closely together to minimize the differences in their standards.

The FASB and IASB developed a conceptual framework to serve as the basis for future accounting standards.To be useful, information must have the fundamental qualitative characteristics, which includes: Fundamental Characteristic

Relevance [ Predictive value , Confirmatory Value , Materiality ] ; Faithful representation [Completeness , Neutrality , Free from error]

Enhancing Qualitative Characteristics : comparability, consistency, verifiability, timeliness, and understandability.

Assumptions in Financial Reporting :

1) Monetary Unit Assumption ; 2) Economic Entity Assumption

3) Periodicity Assumption ; 4) Going Concern Assumption

Principles in Financial Reporting : The accounting principles include: Measurement Principle ; Full Disclosure Principle ;Matching principle .

GAAP generally uses one of two measurement principles, the historical cost principle or the fair value principle.

The historical cost principle dictates that companies record assets at their cost.This is true not only at the time the asset is purchased but also over the time the asset is held.

The fair value principle indicates that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability).Fair value information may be more useful than historical cost for certain types of assets and liabilities.For example, certain investment securities are reported at fair value because market price information is often readily available for these types of assets.

In general, the FASB indicates that most assets must follow the historical cost principle because market values may not be representationally faithful.Only in situations where assets are actively traded, such as investment securities, is the fair value principle applied.

The full disclosure principle requires that companies disclose all circumstances and events that would make a difference to financial statement users.If an important item cannot reasonably be reported directly in one of the four types of financial statements, then it should be discussed in notes that accompany the statements.

版权声明:本文为原创文章,版权归donstudio所有,欢迎分享本文,转载请保留出处!